STARTUP BUILDER, MENTOR, AUTHOR

ABOUT ME

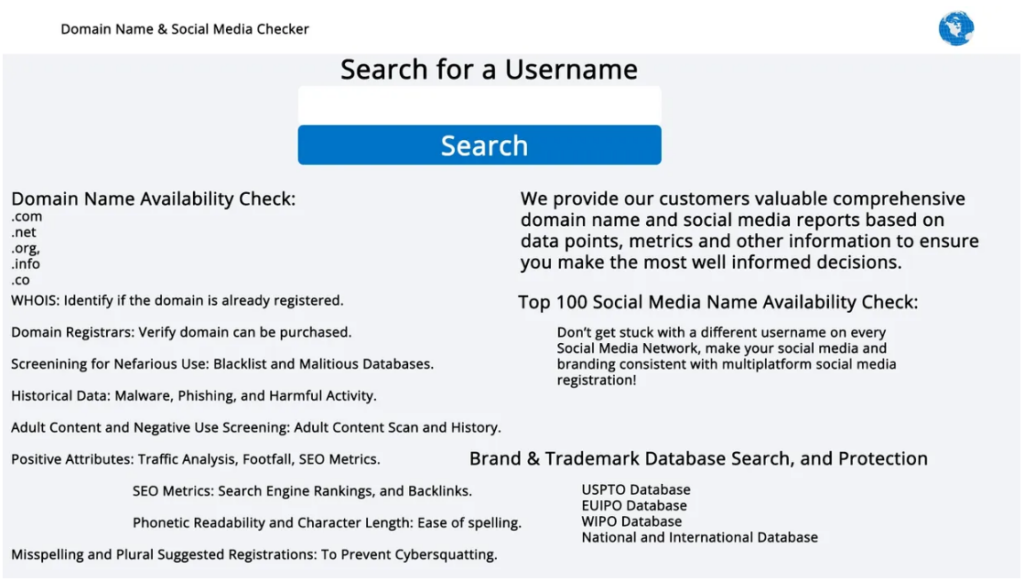

I am Ronald Simons, an entrepreneur in Mt. Laurel, NJ with passion and grit for building sustainable, breakthrough, and disruptive innovative startups. Transforming visionary ideas into successful ventures. As the Founder of Treenia, I strive to streamline domain name search and one-click multi-platform matching social media registration for the next generation of entrepreneurs. Throughout this blog, as you scroll over text, you will find links (backlinks) to many other sites I have inserted to verify the narative of my content. However, I am not responsible for the content, maintenance or security of other sites. All views, content and opinions expressed here are my own, and not of any other person or entity.

STARTUP ACCOMPLISHMENTS & VISIONARY JOURNEY

I’ve built a few startups, Globe Icons Creative, Inc, APT, LLC and Bricks N’ Mortar, S as a contractor at 18. I draw from concepts, principles, and skill-sets I have adopted and learned from my grandparent’s seven Brick-N’-Mortar ventures in Trenton, NJ (business “educo” not taught in schools). They were majority stakeholders in Yellow Cab, Inc. where I also became a Manager at 18 till it’s acquisition at 23, Hamilton Roller Skating Rink. Inc, La Granada Night Club, inc., Olden Brake & Tire, Clinton Transmission, Genesee Ceramics, and Fred’s Diner. While also learning from industry leading mentors such as Robert Shalayda, VP of NOKIA and Larry Sladewski. VP NVIDIA, YC Startup School, Microsoft Training, and being an avid reader. Leveraging partnerships and funding to scale fast while learning from my own failures (many), and working with and through entrepreneurs, and founders of startups I’ve mentored. As the best way to learn how to do something is to do it, and teach it. With the knowledge and ethos of thought leaders such as Eric Ries, Al Ries, Steven Blank, David S. Rose, Esther Dyson, Ash Maurya, Paul Graham, Peter Thiel, Elon Musk, David Bland, Graham Robertson, Steve Jobs, and Cindy Alvarez.

At Globe Icons Creative, Inc. I’ve worked at the intersection of technology and branding as a creative visionary for 15+ years, while active in the domain industry building my portfolio since the mid-’90s; thoroughly researching domain registration and its broader ecosystem, helping entrepreneurs navigate the chaos of digital brand identity tied to digital literacy exploited by a-la-carte registrars, ISP bots and brokers. That also lack trademark and blacklist information that should be provided. Beyond that, finding available matching top social media handles that require being manually searched and manually set up, and the maniocal global cybersecurity threats that seem to have no solution in sight. The struggle to secure a powerful, unified brand online is real… From frontrunning, domain tasting, cybersquating, mismatched social media handles, to branding inconsistency. Startups and entrepreneurs face a ton of issues…

Over the years, I conducted extreme industry due diligence on domain name registrars, social media, and hired Charles Zimmerman, DS at Motorola to confirm phonemes findings. Attended SCORE, and was mentored by Larry Sladewski, VP at NVIDIA to help iterate… Attended countless deep dive meetings with Mike Kaczmareck, VP at Verisign and Jeff Bedser, Chairman of ICANN Global Cyber Security. Drafted a founders accord and recruited a 100% ROTI commitment culture cofounder team with Michael L. Clark, CMO (Ex. VP, Golieth Tech), and Sr Software Architect, Alex Shapiro, (Ex. McKinsey & Co., CTO) and became the Founder of Treenia -built to end this friction. Treenia, doesn’t just match names—we reduce CAC, eliminate friction, and automate what used to take months into minutes.With AI-driven phonetic domain name search, instant matching social media multiplatform registration, and seamless optimization, we make branding effortless—so founders can focus on building, not battling availability.

INTRODUCING TREENIA AND ITS STRONG NON-OBVIOUS UNIQUE INSIGHTS

Treenia streamlines brandable domain name search and social media multi-platform registration.

Leveraging data points to create infinite new things, new ways to sell, and new ways to distribute.

The Paradigm Shift

Treenia is much more than a micro-transformation tool -it’s something users and even registrars could adopt easily. We’re ushering in a fundamental shift in AI search through digital branding. In today’s hypercompetitive online landscape, entrepreneurs and startup businesses simply can’t afford to spend months searching for an available short brandable domain name, then verify the domain name for trademark safety, traffic quality, or hidden risks that can damage brand integrity. Then begin the manual search to see if the matching social media handles are available for it. Our AI-powered platform delivers a rapid, reliable solution that unifies your online identity by eliminating the chaos of lost domains and mismatched social handles. Whether you’re in New York, the Silicon Valley, or anywhere else on earth, Treenia empowers entrepreneurs to command their digital presence with precision scalable innovation that delivers an instant online presence.

Treenia is for:

First-time founders

Brand builders

SaaS startups

Global entrepreneurs

Creators and influencers

Agencies managing identity at scale

Global Registrars, Regestries, and Resellers

They will value:

A Freemium Search

A $5K packaged launch with 12-24 month Lease To Own – LTO

A $500.00 Startup Value Package

A $99.00 Builder Package

Trademark search and services

Peace of mind Dashboard access

Premium upsells and A-la-carte addons

Clean, clear, AI-assisted control

AI-Powered Precision and Evolution

As society pivots from traditional ISP index search to AI search, many of these tasks can be completed individually. However, not comprehensively.

Treenia is evolving into a powerful ecosystem of:

AI-Augmented Intelligence

Human-AI Teaming

Biometric Cybersecurity

Geospatial Intelligence

API-Accessible Agentic Tools

We’re moving beyond SaaS, into AaaS (AI Agents as a Service), with a future fit for both human and machine systems, offering Results-as-a-Service, not just software.

Why Now = market timing + technological inflection + societal readiness:

Treenia is well-positioned for the “post-outbound AI-flooded” future: Where everyone can now send tons of cold emails, write SEO blogs, and make LinkedIn videos using AI. It’s cheap and fast. Because of that, inboxes are getting flooded, trust is going down, and people are ignoring outbound messages more than ever. So even if you send 10x more AI-generated messages, you won’t get better results. It just drives up Customer Acquisition Cost (CAC) — the cost of getting a new customer.

Building from the bottom-up demand generation and engagement: Brand, Audience, captive distribution, virality, reputation, network, etc…

Designing for utility, speed, and instant gratification

Targeting a problem users already feel

Structuring virality and social proof into the product

Avoiding reliance on outbound and paid CAC loops

Building trust, audience, network, and virality.

Treenia simply let’s users discover and share our product naturally. Thus, laying the groundwork foundation for modern branding, biometric cybersecurity, and geospatial intelligence. We transform granular, small-batch consumer insights into enterprise-level B2C and B2B solutions—designed for entrepreneurs, founders, startups and existing businesses who demand excellence and refuse to settle for second-best.

Purpose-Driven Culture and Commitment

At its core, Treenia is powered by a purpose-driven culture that prioritizes long-term impact over fleeting short-term gains. Our mission is to streamline online branding and empower entrepreneurs through advanced AI solutions that foster real value and sustainable growth. We believe in smart execution, relentless accountability, and a work ethic that is as global as it is personal. Every team member—whether working part-time or full-time -is committed to driving innovation and operational excellence. Treenia’s ethos of mission-first strategy, combined with unwavering grit, makes us the ultimate partner for visionary founders and investors seeking to revolutionize digital identity on a global scale.

MY WORK AND BOOK IN PROGRESS

I’m distilling the hard-earned founder lessons of startup building, fundraising, and digital branding into a book designed to be every entrepreneur’s playbook. This isn’t just another business book—it’s a blueprint for modern entrepreneurship, as a tactical founder mode guide built on real-world experience and battle-tested strategies. Inside, you will find a tactical guide on startup execution, branding, funding, and AI-driven growth. I pull back the curtain on what truly works, what fails, and what no one tells you about building a high-impact venture. Starting form the idea. Why? The idea is a solution to a problem that begins in the mind of it’s solo founder. Be it large or small, a paper clip or a better mouse-trap. It all begins as a vision.

As a startup architect, while at the idea stage, I performed due diligence, industry and market research -compiling and organizing this data with use of the Strategyzer business model canvas and the value proposition canvas templates. At Treenia, we’ve successfully validated our concept through a rigorous 3-step market validation process. We began by deeply analyzing the problem space, confirming a clear and growing need for streamlined domain + social handle registration and brand optimization. Our market size analysis revealed a 17.7 million dollar opportunity with underserved user segments ready to adopt bundled solutions. In step three, we mapped out the competitive landscape, uncovering clear white space in automation, instant registration, and AI-driven brand building—gaps our MVP directly targets. With these insights, Treenia is now positioned for funding to accelerate development and bring this game-changing solution to life. A CTO should not focus on building features without small batch testing MVT’s to ensure that only the necessary features are built. This approach helps avoid waste and ensures that resources are allocated efficiently.

We had Alex Shapiro, Senior Software Architect (McKinsey & Co., Warner Music), develop our ‘Zero to One’ POC with these princepals. Creating a Pre-MVP Market Validation Loop (using Treenia’s AI)—testing domain name and social media ideas with 100 potential users via in person, X, and LinkedIn. Then refining and iterating with mentor Larry Sladewski, VP at NVIDIA, based on feedback. Deploying the agile Lean Startup principles (Eric Ries), and customer discovery methodology of Steve Blank’s Startup Owner’s Manual to validate before building -to reduce 29% demand failures, and ensure we “build something people want“. Moving to an instant DM lean sprint, tightening the feedback loop to 10 in 12 hours.

SO WE MADE SOMETHING PEOPLE WANT – NOW WHAT?

The overwhelming results were absolutely compelling evidence. Although I was a former C. Inc. Founder and CEO of an agency, I understood how to fundamentally organize, manage and launch a business. However, something just didn’t feel quite right… I wanted to know why previous and current competitors faced challenges doing just this. My first instict learn… Learn why? I began by identifying cube farm flops that would have been competitors… Then I took a deep dive into tech startups. Being from the East Coast, USA, co-founder Mike Clark (CMO) and I began in search of a scalable, repeatable model to build a rapid-growth Silicon Valley style tech startup. We found startup failure rate statistics revealed 70% of startups fail due to team issues or lack of focus (CB Insights, 2024). Although both of us have in depth prior experience building and running businesses. We examined these startup problems closely to validate them like an idea questioning everything we believed and thought we knew to validate and figure out the best way to build a tech startup in today’s rapid AI startup landscape for success. While I worked applying my years of industry due dilligence, knowledge, business, marketing, domainer, and website building contractor experience with creativity. Michael began mapping our GTM layout.

Michael maps out our growth sprints in 13-week intervals, aligning acquisition, activation, and conversion goals to real-world, weekly performance metrics. Every Monday, he leads a quick review: To hit our weekly targets for free tool usage, lead generation, and paid conversions? What pace toward monthly projections? How we will track the data, identify friction points, and adapt messaging or channel focus in real time. Michael also owns the DRI (Directly Responsible Individual) system for marketing and GTM. He leads with full accountability -no handholding, no silos. Every Friday, he drives our 60-minute sync where scorecards are reviewed, blockers addressed, and execution priorities realigned. This rhythm keeps Treenia lean, focused, and aggressively adaptive, even as we scale. Michael’s approach turns clarity into speed and strategy into measurable traction. Where my ethos is seen from the lens at the bottom of an educational value drip funnel. Aiming for 2K-5K freemium users and 250 paid user traction. Positioning us for options to bypass Angel rounds… While also watching how the new tectonic shift of Venture Capital will shake out as VC Firms Are Becoming RIAs that are roll up private equity giants. Which to fund marketing with WOM community virality at scale and carve a deep enough wedge in in the marketplace will need serious consideration.

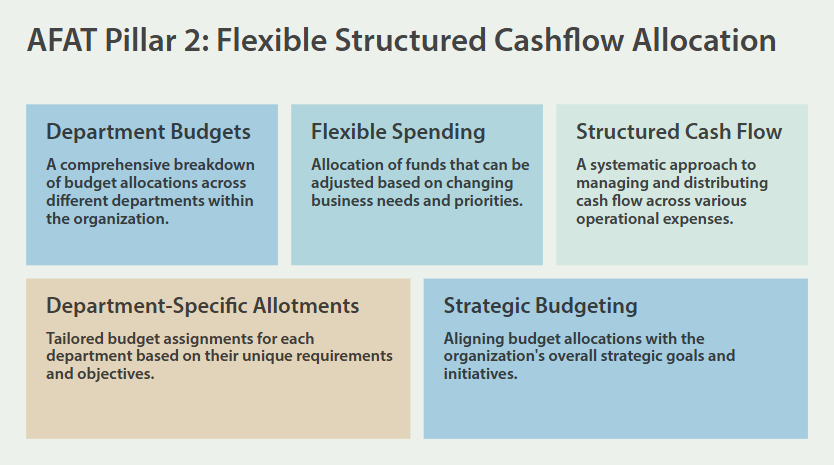

We are currently in the process of refining our Proof of Concept (POC) and exploring opportunities to scale. We’re looking for strategic partners who share our passion for disrupting the digital branding space and can bring valuable insights and expertise to help guide us to the next stage of growth. At Treenia, our ‘Ganas’ recruitment style is directly inspired by Stand and Deliver, and the Marshmallow Experiment’s focus on grit, with delayed gratification to counter burnout (16%) and team issues, aligning with 80% of successful founders citing expertise. Together with a flexible, structured cashflow budget allocation of 15–19% per department. Making VC funding optional for scalability addressing 29% funding failures and 42% scaling risks. While it insists on onboarding only those co-founders who are not only experts in their domains but are also visionary contributors with a relentless entrepreneurial spirit. To achieve velocity which is not just a measure of speed, but a multifaceted indicator of progress and efficiency of startup teams.

As the Founder of Treenia, I’ve seen firsthand how the startup landscape has shifted in the AI era, where a solopreneur CTO can 10X their outbound output but also faces 10X the responsibilities. Ahmad Nassri’s “Startup CTO Cheat Sheet” highlights this burden: a modern CTO must juggle analytics ownership, software engineering, customer metrics, security, and more, all while navigating conflicting roles as Chief Marketing, Digital, Technology, Security, and Information Officers. For a solopreneur CTO, this means wearing all hats—from coding and product development to strategic vision and team leadership—often leading to burnout by year four, as Nassri’s growth cycle shows the role evolving from “The Maker” (<5 engineers, $1M ARR) to “The Executive” (>50 engineers, $20M+ ARR). I experienced this myself as a non-technical solo founder using AI, struggling to keep up before realizing the pitfalls of fractional CTOs, who, as Nassri notes, can leave projects unfinished and misaligned with a founder’s vision, risking clawbacks from VCs if undisclosed, as I’ve witnessed happen.

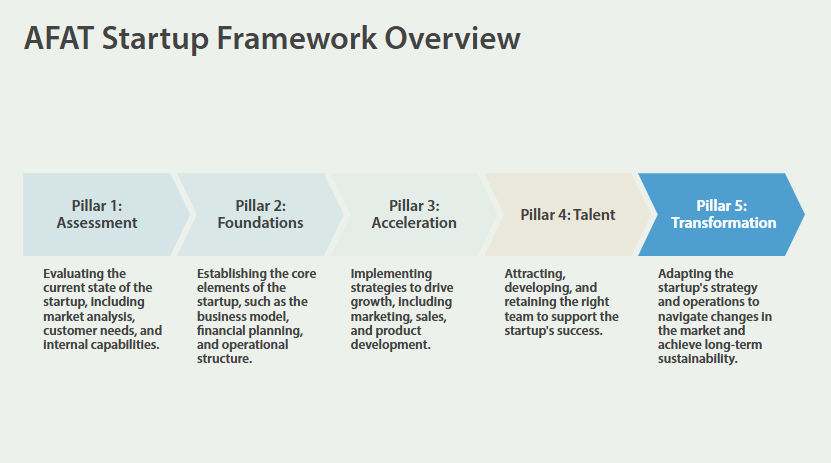

In contrast, we developed an iterative, robust hybrid, indie-hacker-vibe startup framework we call “AFAT” that demands co-founder strategic alignment -De-risking the startup (from the very beginning before just filing paperwork to COI and start a business). The AFAT Startup Framework offers unique insights for today’s lean team startup landscape, where 90% fail globally—20% in two years, 45% in five, and 65% in ten (D’Souza, 2025). The AFAT Hybrid One-Five-Founder Model with 10:1 dual-class shares, and 100% ROTI (Return-On-Time Investment) purpose driven commitment culture tackles the 23% team failure rate by ensuring aligned, execution-driven founders.

The AFAT is a new startup framework needed for a new era of AI startups here’s WHY?

It is now 2025, the SaaS hustle-maker/Indie Hacker era with an AI feature is struggling, and it’s largely because VC-backed solo founders who don’t transition to a purpose-driven culture will likely fail. The next 18 months will filter out “hustle for hustle’s sake” AI startups. Those who don’t evolve into purpose-driven, customer-centric companies solving real world meaningful problems will either pivot or die. What is rising: a new wave of lean, agile, and mission-driven teams that know how to execute with clarity. While in 2025 we may also see the first 1 Founder human and all AI co-founder led startup with 5 roles, 1 engineer. 1 designer. 1 product lead. 1 growth lead. 1 ops person that is it. NO EMPLOYEES!

- AI Has Flattened the Playing Field

The indie hacker model thrived when unique engineering skills gave founders an edge. Now, AI enables non-technical founders to ship products faster, reducing the technical moat and making distribution, branding, and customer alignment far more critical. Without a clear purpose and differentiated vision, many solo-built products are just features, not companies. - Funding Now Favors Sustainable Business Models

Investors are no longer throwing money at “growth at all costs.” They’re backing teams with strong execution, customer alignment, and real business models. Solo founders grinding without a clear, purpose-driven direction (beyond just launching products) will struggle to gain traction and funding. - The Death of the Solo “Grind to Exit” Model

Many past indie success stories were built on low-cost acquisition channels (organic SEO, virality, early social media arbitrage, etc.) that are now saturated. Building a defensible company requires a strong team and culture, not just a single founder cranking out features in isolation. - Customer-Led Growth Is Beating Feature-Led Growth

Hustle culture was obsessed with shipping fast and iterating. But now, customer discovery, trust, and brand affinity drive adoption more than ever. Companies that aren’t deeply aligned with their customers’ evolving needs will fade out—especially those led by solo founders stuck in a build-first mindset. - Purpose-Driven Cultures Outlast Short-Term Hustlers

Startups that prioritize a mission, purpose driven commitment culture, and long-term vision attract better teams, retain customers, and survive downturns. VC-backed solo founders who lack this foundation will burn out, fail to hire effectively, and ultimately struggle to adapt as market conditions tighten.

THE ADAPTIVE FOUNDER AI BLITZ TRIANGLE (AFAT) STARTUP FRAMEWORK

Unveiling the Path to Startup Success: Why Team Dynamics Matter Most in 2025

As Founder of Treenia, I’ve always believed that who you build with defines your startup’s destiny—a truth echoed in Stanford University Professor Ilya Strebulaev’s Unicorn Report. Surveying over 500 venture capitalists, the report reveals that team dynamics are the top failure factor for startups, with 55% of VCs citing it as critical, rising to 60% in IT and 48% in healthcare. This aligns with my AFAT Startup Framework’s core pillar: a purpose-driven, execution-focused team culture, ensuring alignment and grit to drive scalable innovation.

Strebulaev’s data shows startups with 3–4 founders are 74% more likely to become unicorns, while solo founders falter 38% more—underscoring Treenia’s Hybrid One-Five Founders Model for AI-driven startups in Silicon Valley and beyond. Venture capital-backed failures often stem from misaligned teams, not just tech or timing (only 8–9% of VCs cite these). Embrace our Ganas recruitment and 100% ROTI AFAT ethos to transform your entrepreneurial journey for global impact.

The startup world is riddled with outdated playbooks and bad habits. Far too many founders face a false choice: either bootstrap and struggle endlessly or chase angel investors and venture capital that relinquish control. High-burn, high-risk startups even those that are VC backed often burn out by year four because they’re built on misaligned incentives, passive founders and premature scaling.

Today a growing wave of startups begin with a non-technical Solo Founder and AI. I was once in that position—launching as a non-technical solo founder using AI before adopting a purpose-driven culture.

WHY?

The AFAT isn’t merely about launching a business with a minimum viable product… it’s about constructing a company built for long-term success. While many startups rush to build-measure-learn using Lean Startup methodology, AFAT begins with a commitment-first, execution-driven blueprint that forces founders to think beyond mere survival. In an era where solo AI founder startups based solely on feature novelty are bound to fail, this framework provides a strategic north star… not a rigid destination. We encourage ongoing refinement, with deep attention to risk management, financial rigor, and the application of real-world case studies. AFAT is a compass, not a map, guiding founders toward building enduring, scalable companies.

AFAT HYBRID STARTUP FRAMEWORK FIVE KEY PILLARS

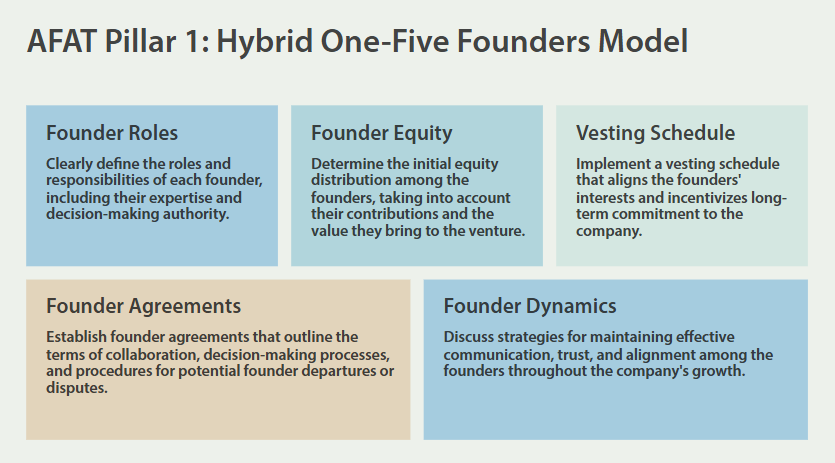

1. The AFAT Hybrid One-Five Founders Model

Today with AI lean startups begin with a Solo Founder and will need to grow from 1–3 core roles (e.g., Visionary, Tech, Brand) based on stage, with use Artificial Intelligence AI agents, chatbots, and machine learning (M/L) automation for workflows, legal, finance, or other tasks. At Treenia we utilize Founder Advisor FAST Agreements and Specialist EASE agreements for fractional equity (0.5–2%) -These are used to compensate advisors, specialists, or part-time contributors until onboarding a CLO and CFO co-founders growing to a full five co-founder team when justified.

Roles: CEO, CTO, CMO, CLO, CFO

- Each founder has vision, grit and a clearly defined role, deep domain expertise, and accountability.

- Dual-class shares (10:1) ensure that strategic control remains in the hands of active, committed founders.

- 100% ROTI (Return on Time Investment) purpose driven commitment culture.

- There are no free rides. Equity isn’t simply granted by tenure—it’s earned through execution and results.

- 4-Year Vesting with a 1-Year Zero out Cliff (ensuring any equity not fully vested returns to the startup.

- 1/48th monthly for the remaining 36 months until full 4 year vesting.

- Secondaries post-QSBS, ensuring liquidity that aligns with each founder’s contribution over time.

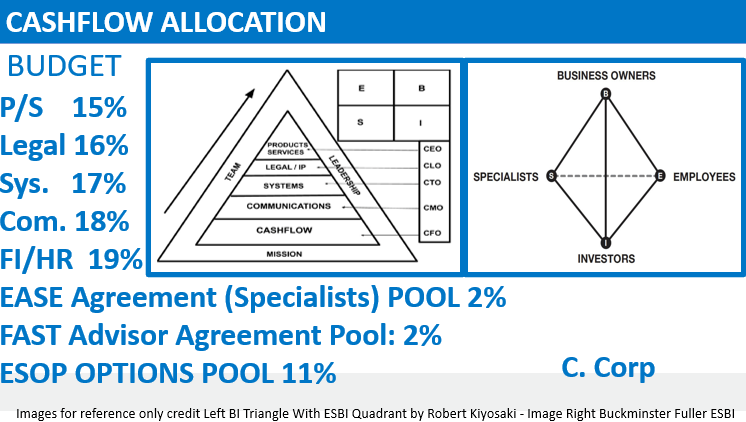

2. Flexible Structured Cashflow Departmental Size Allocation Driven Performance

We examined startup frameworks, and the BI Triangle’s eight integrity business components structure of Robert Kiyosaki, and Buckminster Fuller. With a focus on Mission, Team, Leadership, Product, Legal, Systems, Communications. and Cashflow. To find a flexible way to allocate funds as a guide to ensure each department can be funded to scale, while thinking through headcount, forecasted expenditures, and SG&A. To allow smaller niche startup teams to allocate budgets, as they onboard to keep a flexible budget while bootstrapping to pay for CLO and CFO services as needed and delay recruiting CLO, and CFO cofounders to suppress costs.

- 15% for the CEO (Strategy, Vision, Growth)

- 16% for the CLO (Legal, IP, Compliance – Be safe rateher than sorry)

- 17% for the CTO (Technology & AI Development – Usually leaner due to AI)

- 18% for the CMO (Marketing & Brand Growth – Teams, and teams need funding and budget)

- 19% for the CFO (Financial Strategy, HR, Capital Allocation-The largest department)

- 15% Options Pool (Employees, Advisors, Specialists)

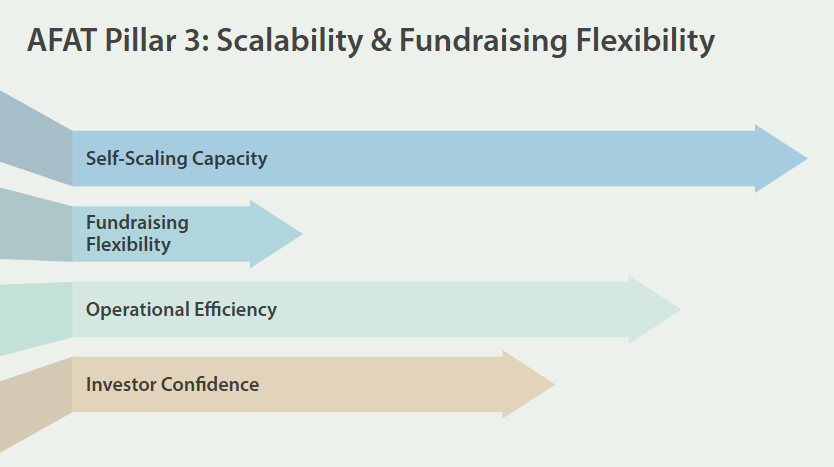

3. Scalability & Fundraising Flexibility

- Raising angel investor and venture capital from VC firms investing in AI is an option—not a necessity—allowing the startup to scale on its own terms.

- The AFAT framework forces startups to plan for the future pre-launch, post MVP.

- It demands every co-founder be strategically aligned and fully committed to the company’s long-term vision (a co-founder may start part time while also employed elsewhere until sustainable, at which time they must become a full-time co-founder). Note: A VC will not fund a startup with a co-founder that is not full-time.

- There’s no room for passive equity or dead weight—only true builders who execute.

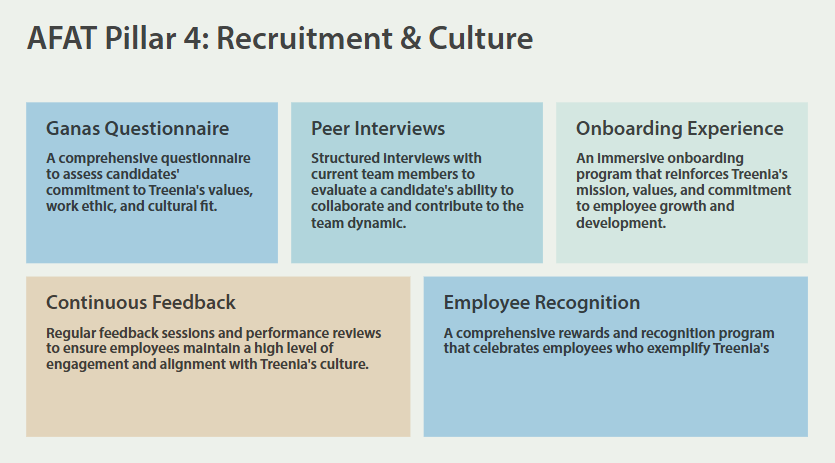

4. Recruitment & Culture

- A Purpose-Driven Commitment Culture is The True Differentiator

Traditional lean startup methodologies focus solely on launching an MVP to validate an idea. In contrast, our commitment culture goes deeper—it’s about who you choose to build your company with and how that team envisions the future adopting “Zero to One” innovative first principles thinking, taught by Peter Thiel at Stanford University.

Treenia’s Talent Recruitment: Driven by Ganas

At Treenia, our recruitment process mirrors the essence of the classic film Stand and Deliver, where the focus is on passion, drive, and the grit determination to succeed against extreme challenges of adversity—qualities defined as “Ganas ~ Desire”… Treenia, is living the AFAT principles, proving that commitment and execution can redefine the startup playbook. Join us in shaping this future.

When we seek talent, we’re not just looking for skills or qualifications, but for individuals who possess that relentless drive to overcome obstacles and make an impact. Just as the students in Stand and Deliver rise above adversity with grit and focus, demonstrating a willingness to learn calculus. By becoming a cohort team held to extreme accountability, they accomplished together what the status quo believed was impossible, and that is the power of teamwork. We want team members who are scrappy, and ready to take ownership, make bold decisions, and contribute to Treenia’s mission and vision of reshaping the future of digital branding.

At Treenia, it’s all about heart and hustle

We look beyond resumes to uncover the inner spark that propels individuals to overcome challenges and excel. Much like Jaime Escalante recognized the potential in his students despite their humble beginnings, our rigorous interview process identifies candidates who display an endless willingness to learn, are coachable, display relentless determination, creativity, and a hunger for success. This approach ensures that our team is built on diverse, resilient, and motivated talent committed to transforming digital branding and pioneering innovation.

Questions we ask everyone…

- What do you love to do so much that you would do it for free?

- Tell me about a time you made a decision few people agreed with?

- What excites you about Treenia’s mission of streamlining online branding and social media integration?

- What’s the most important lesson you’ve learned in your career, and how has it shaped your approach to work?

- What unique perspectives or skills do you bring to a team, and how do you think they would contribute to Treenia?

- If you could improve one aspect of Treenia’s user experience, what would it be and why?

- Where do you see the future of online branding, and how would you help Treenia stay ahead?

We select only those visionary contributors who bring deep domain expertise and an unwavering entrepreneurial mindset. Thus, we want founders and team members who are ready to take ownership and contribute to long-term success, gel as a team through our customer development methodology regardless of whether they start part-time or full-time—it’s about making every moment count. Part-time co-founders are welcome, but dedication and consistent contribution are non-negotiable.

- We are a tightly knit elite team

- We are not transactional clock-watchers

- We are equally obsessed, talented and aligned

Every member commits to 1% more daily, compounding into 1–2% weekly wins (6–12% monthly)—be it one email, one task, or one sales call. Although we are human, we hold each other to strict actionable innovation accounting, while balanced and flexible with empathy… We don’t hesitate to exit the wrong people from the bus because we’re drivers, not passengers. Objective 20% MOM growth rate at PMF for 9X YOY!

Our culture ensures:

- Employee Loyalty & Retention

- Consistent Performance & Growth

- Long-Term Stability

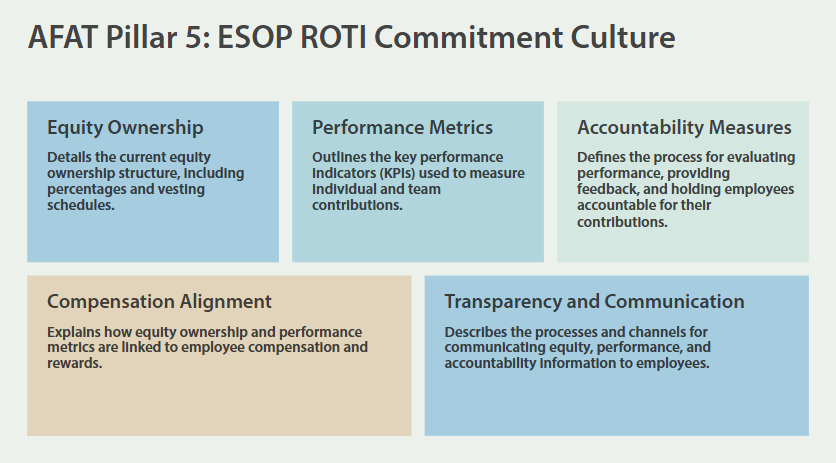

5. ESOP (Employee Stock Ownership Plan) 100% ROTI (Return-On-Time Investment) Purpose-Driven Commitment Culture Performance Based Founders Accord

We began by drafting a Founders Accord (A temporary draft of a co-founder’s agreement for use while recruiting our cofounders with our temporary entity prior to COI (some call this Stealth-Mode; ensuring we recruited the right cofounder team, before we filed a certificate of incorporation (COI) which starts the startup velocity clock in front of investors. In short, it bought us time to think it through, recruit, build trust and gel together while holding each other to accountability by tracking performance (with the ability to root out passive founders) without sacrificing equity.

“We Are Not Attorneys, And This Is Not Legal Advice”. The AFAT Startup Framework below is our boilerplate.

For this we adopted a temporary document used in place of a formal Founders Agreement (that has much more stringent framework and usually requires final drafting by a startup business attorney). In the beginning… It is wise that everyone even co-founders sign an NDA with IP clause that anything made, discussed or shared, belongs to the entity owned by X…………………. a slated entity to be founded as X…………………………., Inc.

Each founder irrevocably assigns all rights, title, and interest in any intellectual property (IP) created in connection with the company to [Startup Name]. This includes but is not limited to patents, trademarks, copyrights, and trade secrets. Founders shall not engage in, advise, or fund a competing business for a period of [X months] post-departure. Thus, All intellectual property (IP), including ideas, designs, code, processes, and trade secrets, whether created before or after incorporation, shall be deemed assigned to the company if utilized in any form for company-related purposes. Any IP carve-out must be pre-approved by the Board, with a signed agreement specifying ownership.

- All IP created—past, present, and future—by any founder is owned by the company, not individuals.

- No carve-outs for pre-existing work unless explicitly approved by the company (prevents disputes about “prior inventions”).

- Non-compete & non-solicitation clauses should last at least 36 months post-exit (subject to local legal restrictions).

(As a rule of thumb investors will not sign an NDA) … Their primary interest is in you and are they confident you are not only a team of experts, building a startup. You are going to actually do what you say you can do.

- Defined Roles and Responsibilities:

It outlines each founder’s specific roles and decision-making authoritiy, helping to prevent misunderstandings and ensuring everyone shares a common vision for the company. - Structured Conflict Resolution:

Establishes clear procedures addressing disagreements, reducing the likelihood of prolonged disputes. - Clear Equity Distribution:

The document details each founder’s ownership stake, minimizing ambiguities and helping align expectations regarding contributions and rewards. - Protective Provisions:

It includes measures to safeguard the interests of both the company and its founders, particularly in situations where a founder may leave or be unable to continue their role—an important consideration during the early, vulnerable stages of a startup. - Intellectual Property Assignment:

The agreement clarifies the ownership of intellectual property (IP), which is critical in maintaining a competitive edge and ensuring that innovative contributions are properly recognized.

A. Equity

Our equity distribution follows industry-standard splits from over 7,000 startups (via Carta) to keep our cap table investor-friendly the following is drafted into the Founder’s Accord and Founder’s Agreement Prior to COI. Equity is allocated based on responsibilities, market norms, and contribution levels, subject to Board approval.

Having all of this formula locked into the founder’s agreement ensures all founders – co-founders understand the allocations will change as each member is onboarded during growth, not based on greed or perceived value-yet based on what works. In today’s startup environment, team sizes are shrinking. CTOs are demanding higher equity stakes…

Why the Equity Split in the Carta Chart Totals Only 95% (Not 100%)

The 5% difference you’re seeing is intentional and very common. Here’s why:

📌 What the 95% Represents

The equity splits shown in the Carta chart reflect the median founder allocations before any fundraising, but after reserving space for other critical needs:

The Missing 5% Usually Goes To:

Use Case Typical %

Future early hires 2–3%

Advisor/board equity 1–2%

Flexibility buffer 1–2%

So even pre-COI, savvy cap table planning leaves room for:

ESOP/Options Pool

Advisory Shares

Future Co-founders or “earned-in” contributors

External talent acquisition

Equity-based incentive offers (FAST, SAFE triggers, etc.)

✅ Carta’s Chart Reflects Reality of Cap Table Design

This is not a mistake, it’s best practice.

If you issued 100% to founders immediately, you’d have no flexibility without creating dilution the moment you needed to bring someone on. That would slow you down or create friction (and risk QSBS resets).

However, many of these Indie hacker style startups are failing instead of scaling due to greed. Where the ideology is not focused on building and launching a successful startup… Its focused on launching a mediocre product and hope for acquisition exit. Instead we are passionate founders focused on building an investable, repeatable and scalable Silicon Valley style rapid growth tech startup, that solves real world problems with deep meaningful resonating impact… built for long range X2, X2, X3, X3, X10 results.

- 1-Founder Team: CEO holds 100%

- 2-Founder Team: CEO 55%, Partner 45%

- 3-Founder Team: CEO 47%, CMO 33%, CTO 17%

- 4-Founder Team: CEO 40%, CMO 27%, CTO 18%, CFO 10%

- 5-Founder Team: CEO 35%, CMO 22%, CTO 17%, CFO 12%, CLO 9%

WHY?

It is important to note: The business model is a pyramid structure, that forces founders to determine equity distribution by department size, and head counts as you move forward. Thus, reducing friction and arguments later about equity splits, department sizes, time, and responsibility. The key is business success, not personal gratification.

B. Terms

- Performance Accountability (No Free Rides). Each member commits xyz time to the entity progressively. (Eg) If a co-founder fails to meet their defined responsibilities for [X] consecutive months, or materially underperforms against agreed-upon deliverables, the remaining founders may initiate a buyout of their vested shares at a pre-determined fair market value or nominal price. For-Cause Removal Clause allowing founders to be removed without equity vesting acceleration if they fail to perform. Whereas, A founder may be removed for failure to meet key deliverables over [X] consecutive months, breach of fiduciary duty, misconduct, or other material violations. Removal requires a majority vote of the Board, excluding the affected founder. Unvested shares return to the equity pool, while vested shares may be repurchased at either (a) fair market value (if a Good Leaver) or (b) nominal value (if a Bad Leaver based on misconduct, fraud, or negligence).

- Shared = Dilution

- Purchase 85% of 10M Dual-Class Shares filed with a PAR Value at COI of $0.00001. Prior to Fundraising.

- Delaware C. Corporation – Certificate of Incorporation (COI)

- File Section 83(b) a provision under the Internal Revenue Code (IRC) that gives startup founders and employees the option to pay taxes on the fair market value of their restricted stock at the time it is granted. If you do not file an 83 (b) election in 30 days of issue, your stock will be taxed on its fair market value at the time it vests. Must Be Filed Within 30 days of COI Before Any Fundraising.

- 15% Equity Pool

-11% for Employee Options (Evergreen Pool)

-2% for EASE Agreement (Specialist Contributions) Example: Specialist to provide something of need… Pre-Seed Pre-Money Startup Value at $6M for 0.25% equity in exchange for service needs to = $15,000.00

-2% for FAST Agreement Advisors (with a cost for a 0.25% equity – make sure they pay for it and have skin in the game). Also be sure this is tied to a commitment for time, and not dead weight. - All founders have a 4-year vesting schedule with Reverse Vesting beginning with a 1-Year Zero-Out Cliff followed with 1/48th Per. Mo for 36 Mo. Bad Leaver vs. Good Leaver Clause Buyback Provision ensuring that if a founder leaves voluntarily or is fired for misconduct, their equity is repurchased at nominal value rather than fair market value.

- 10:1 Voting Power Dual-Class Shares (Common for Founders & Preferred for Investors) ensuring founder control).

- Provisions for Secondaries Post-QSBS (Qualified Small Business Stock) and Acceleration if acquired Lock-Up Period – No founder may engage in secondary sales of shares prior to Series A without Board approval. After Series A, founders may sell up to [X]% per year post-QSBS qualification, ensuring liquidity without destabilizing control. Any exceptions must be pre-approved in writing by the Board.

- All out of pocket founder-provided resources to the startup: Founders’ out-of-pocket expenses shall be treated as either: (a) Reimbursable Loans, repaid post-funding when the company reaches [$X revenue or Series X funding], OR (b) Convertible Notes, allowing conversion into equity at the next fundraising round’s valuation, subject to Board approval..

- The CEO secures 1 Board Seat plus an additional vote to resolve disagreements Until Series A close. Founder must be willing to step aside, if necessary, for a new CEO. However, still maintains Board Seat with full compensation, immediate acceleration and secondaries for all shares. If the CEO’s leadership is deemed ineffective by a supermajority Board vote (e.g., 75%+), they may be replaced. The CEO retains Board representation and immediate acceleration of their vested shares but must transition to a strategic advisory role unless otherwise agreed.

Conclusion: The Future of Startup Success

The AFAT is for founders who build, execute, and scale without falling prey to traditional startup failures. Fractional hires will never get rich by merely renting their time; real wealth comes from owning equity. We welcome part-time co-founders, but dedication and consistent contribution are non-negotiable.

- If you’re an investor, founder, or operator, it’s time to rethink how startups are built. The next generation of high-impact companies will be crafted by those who master commitment, alignment, and execution… For maximum DCF (discounted cash flows) valuation, based on value, structure, and risk.

Being a great startup contract crafter of your co-founder agreement is crucial for setting clear expectations and preventing disputes as your startup grows. Here’s what you should include:

1. Basic Information

- Company Name & Purpose: Define the startup’s mission and business activities.

- Co-Founders’ Details: Full legal names, roles, and responsibilities of each co-founder.

2. Equity Ownership & Vesting

- Equity Split: Percentage of ownership each co-founder gets.

- Vesting Schedule: Typically, a 4-year vesting schedule with a 1-year cliff (i.e., if a co-founder leaves before one year, they get nothing). This prevents someone from walking away early with a large stake.

- Acceleration Clauses: Conditions under which vesting accelerates (e.g., acquisition, firing without cause).

3. Roles & Responsibilities

- Decision-Making Process: How key business decisions will be made (e.g., unanimous vote, majority vote).

- Duties & Time Commitment: What is expected from each co-founder in terms of work contribution and time.

4. Intellectual Property (IP) & Confidentiality

- IP Assignment: All IP created by the co-founders related to the startup belongs to the company, not the individuals.

- Non-Disclosure Agreement (NDA): Co-founders must keep company information confidential.

5. Compensation & Expenses

- Salaries (if any): Whether co-founders will be paid and under what conditions.

- Expense Reimbursement: What business expenses the company will cover.

6. Decision-Making & Dispute Resolution

- Voting Rights: How voting power is distributed (e.g., proportional to equity, equal votes per founder).

- Tiebreaker Mechanism: What happens in case of a deadlock (e.g., board intervention, external advisor).

- Dispute Resolution: Mediation, arbitration, or jurisdiction for legal disputes.

7. Founder Exit & Termination

- Voluntary Exit: What happens if a co-founder wants to leave.

- Involuntary Removal: Conditions under which a co-founder can be fired (e.g., misconduct, underperformance).

- Buyout Provisions: How the company or remaining founders can buy back an exiting co-founder’s shares.

8. Non-Compete & Non-Solicitation

- Non-Compete Clause: Prevents co-founders from starting or joining competing businesses (may be limited by law in some regions).

- Non-Solicitation Clause: Restricts poaching employees, customers, or investors for a certain period after leaving.

9. Governing Law & Jurisdiction

- Specifies which country or state’s laws apply to the agreement. For example, Delaware law is common for US startups.

Now get to work – Time is money – The more you waste – The more you lose!

Take the time to craft your Founder’s Accord with your co-founders as a team, and review each step carefully to avoid any misunderstandings, and work through them amicably. Treat it as if it were your formal Founder’s Agreement and when you are ready to have a Lawyer draft your Founder’s Agreement, and file your COI, cut the equity pie, and Launch… You have already accomplished something great together that most others fail before they startup. As for performance… Be mindful and make a log… Time is everyone’s most precious asset, and sacrifice -be sure to be human. However, silence is a tell-tale sign of abuse and often begins by someone not showing up late or not at all for either scheduled meetings, or an important meeting they are required to attend.

BLOG-THOUGHTS ON INNOVATION AND LEADERSHIP

Ideas That Shape the Future

Every post here is a step toward sharing the knowledge I’ve gained through years of hands-on work in the startup ecosystem. From AI tools to funding strategies, this space will cover everything from vision-driven leadership to operational efficiency.

Educo I learned from my grandfather… I used it here to create the one page business plan for a startup service contractor as a business model framework and playbook below… PAY YOURSELF NOT TO WORK!

At age 18 I created my first business… Bricks N’ Mortar The High School Super Intendant was my first customer.

“NEWCO” STARTUP Template Framework and playbook below is a high-profit contractor business model I built for masons, roofers, landscapers & remodelers. With a $5,200 sidewalk job (materials = $2600, labor = $2600), you net $3,880 profit by hiring 1099 cash crews and working smart. One skilled, one unskilled = 2 days, then repeat. Fuel, food, tools, and insurance are baked into every project. Use your home office, vehicle, and phone for tax write-offs. Track every dollar, pay yourself first, and scale with 3 jobs/week = $11.6K/month. Built lean for growth. #ContractorHustle #ServiceBusiness #1099Workforce #HomeImprovementStartup #LandscapingBusiness #RemodelLife #RonaldSimons #ConstructionCashFlow #StartupBlueprint

Hire Great People Foucused On Excellence!

EDUCATION

Thomas Edison State University GPA: 3.9

Microsoft AI Startup Certified and Trophy Awarded: Build an Early Stage Startup (October 2023)

Microsoft Startup Fundamentals (September 2022)

Microsoft Startup Fundraising (September 2023)

Khan Academy Business Administration and Management, General (January 2007)

💼 TRUSTED BY INDUSTRY LEADERS

I’ve had the privilege of collaborating with, learning from, and being advised by some of the most accomplished minds in AI, cybersecurity, branding, and venture capital, including:

Stephen Joseph, Esq., Angel Investor

Mike Culliney, VP Unilever (Retired)

Robert Shalayda VP NOKIA, Wharton Valuation Associates

Larry Sladewski, VP NVIDIA Growth Graphic (Retired)

Alex Shapiro, Senior Software Architect, McKinsey & Co., Warner Music Group

Mike Kaczmarek, VP VeriSign

Jeff Bedser, ICANN Global Cybersecurity Chair

CONNECT WITH ME LET’S BUILD SOMETHING GROUNDBREAKING

Ready to disrupt an industry? Whether you’re an investor, founder, or strategist, let’s connect and explore new frontiers in AI, branding, and digital identity. Reach out—I’d love to collaborate on what’s next.

What’s your experience with hustle culture—has it worked for you, or do you see it fading too?

Or after AFAT, Which pillar resonates most with your startup journey?

Empowering entrepreneurs to make their mark—one domain, one profile, one business at a time.

X @RonaldSimons – LinkedIn Ronald Simons

©Ronald Simons 1993-2025 all rights reserved